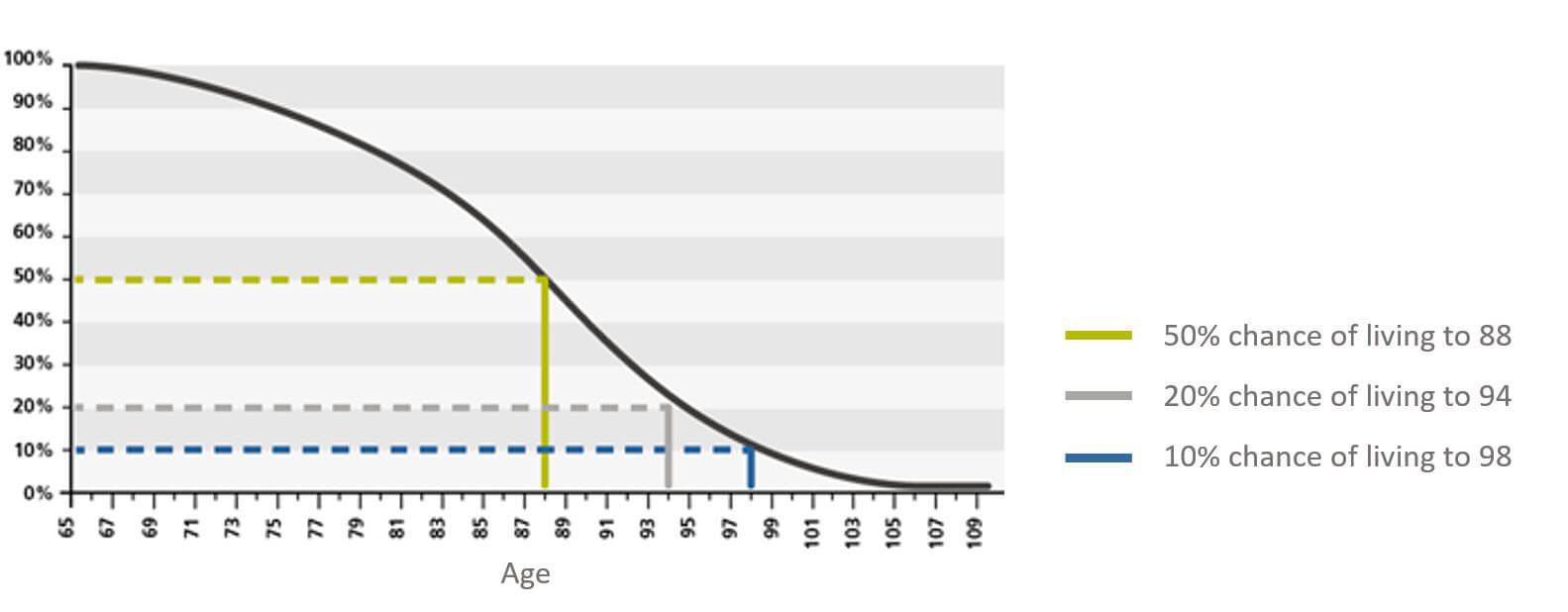

While living a long and healthy life is a goal for most of us, it does raise a valid question. Is there a chance that you could outlive your savings?

Why does living longer matter in retirement?

The risk of outliving your savings is known as longevity risk. With Australians living for longer it is more important than ever to make sure your savings will go the distance.

- Research* shows that Australians retiring today are living a staggering ten years longer than in the 1990s.

- When improvements in medical care and living standards are taken into account a 65-year-old today can expect to live well into their 90’s and may now spend up to three decades in retirement.

Source: Challenger Life Company estimates

The retirement income challenge

A big challenge for Australian retirees is how to plan for retirement income that will last a lifetime. Income from super such as an account-based pension is generally not guaranteed which means payments will stop as soon as your account balance runs out. Poor share market performance can also put you at risk of outliving your savings. Adding a source of regular income such as a lifetime annuity to your retirement income plan can help you manage the risk of outliving your savings.

Feel confident your retirement income will last as long as you do

Living for longer requires a smarter approach to planning your income in retirement. The good news is that it doesn’t need to be complicated. It starts with three key steps.

- Understand how long your super and savings will last. As a rule of thumb, you should plan to be able to meet your essential expenses for the rest of your life.

- Get support from the Age Pension. If you’re eligible, the Age Pension can form part of your safety net income. Bear in mind that even the full Age Pension entitlement may not be enough to cover the cost of living of a modest retirement.

- Secure your retirement income with a regular lifetime income stream. A lifetime annuity can boost your safety net income with regular income for life, giving you confidence you can pay for your essential expenses even if you live to age 100 or older.

Managing the risk of outliving your savings – what are the options?

- Talk to a financial adviser about how long your super and/or savings may last.

- Check your eligibility for the Age Pension. The sooner you prepare to apply for the Age Pension the better, as it cannot be back-paid.

- Consider a regular lifetime income stream such as a lifetime annuity to complement your retirement income.

*Challenger Retirement Income Research, September 2019

Source: Challenger

Concerned about outliving your savings? Our expert Private Wealth team is here to help. Contact us today to discuss your retirement plan and ensure you won’t outlive your savings.