We are talking today about business structures and in particular the disaster that is companies when running a small business. We need to go back in history and look at the year 1999, the Federal Government of that year changed the rules on small business. In particular, they put in place the Small Business Capital Gains Tax (CGT) Concessions and they may as well have written into the legislation that if you’re not running under a family trust or a unit trust for your business, it is an absolute disaster – especially if you’re trading under a company structure. I’ll explain a small business structure, or a small business under a company structure, and how it is an absolute disaster.

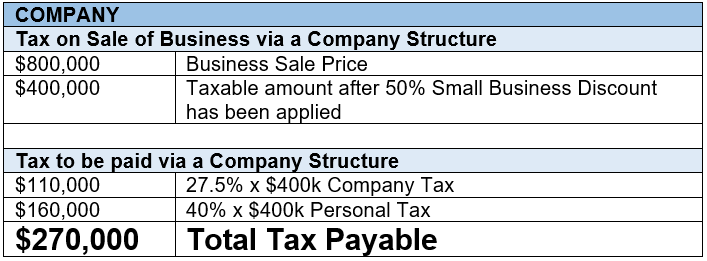

Company

As an example, we’ve got a business worth $800,000 and the family are going to sell under a company structure. When they sell they get a 50% small business discount on their capital gains tax, so now they only have to deal with an amount of $400,000. The $400,000 is taxed at the company rate, which is 27.5%, and that’s $110,000 in company tax. But this is the kicker, folks, and it kicks right where it hurts. An additional $160,000 has to be paid in personal tax when you’re trying to get hold of the discounted $400,000, which is not taxed by the company, and that is the kicker, folks. Even though you’re getting a 50% discount on capital gains tax for the company, it’s when you try to pull that $400,000 out of the company, the tax office hits you with this extra $160,000. So in total, they kick you where it hurts at $270,000 in tax. That my friends, is the disaster when selling a small business under a company structure, and it gives me the absolute shivers when we have clients coming in stuck in these company structures.

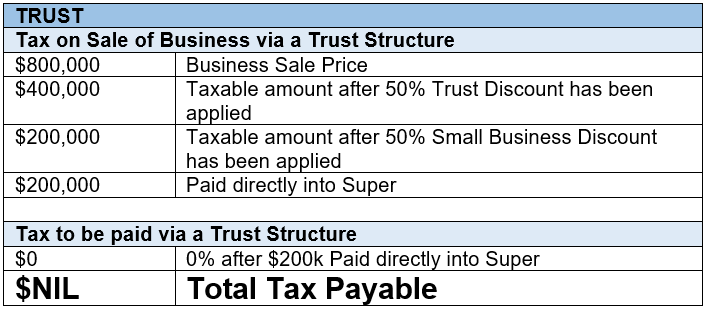

Trust

Let’s have a look at what happens in a trust for the same small business. First of all, the trust gets a 50% discount. Only trusts and individuals running in business get this extra 50% discount on capital gains tax. Once again, we’re dealing with $400,000. The $400,000 then gets another 50% discount and it’s the same discount as what the company gets, which is a small business discount. Now we’re dealing with the remaining $200,000 and the tax office allows us to put that $200,000 directly into superannuation. And you guessed it folks, the amount you pay is $0 in tax. So that my friends, is how you set up in business.

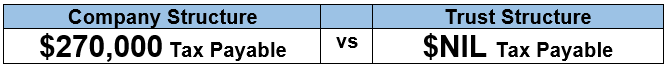

A Trust Structure Will Save You $$$

Even today, when the tax office looks like they’re squeezing out trusts, they are not. You need the right tax advice to do this. And some people say, “Oh no, I can’t set up under a trust structure, it’s so complicated with settlors, appointors, beneficiaries, trustees and trust deeds”. Get over it and trust in your accountant. Trust that they are going to put you into a trust. Here’s a little bit of a comparison: look at the complication between $0 and $270,000.

I’ve said this before in another article, keep it complex stupid when you’re structuring your small business. I cannot put it any plainer than this: you must set up your growing small business in a trust structure, and if you’re advised to set up in a company, get your head read. If you’ve got a growing small business and you’ve got a company structure, don’t go back to your tax accountant, go to a psychologist ’cause you are in trouble.

That’s all I’ve got for you today, folks, a quick story, a succinct story. Get into a trust if you’re not already, and if you’re starting out and you’re going to make some dough, get into a trust structure because capital gains tax will kill you. Of course, as there are many ways to skin this cat you need seek advice for your individual circumstances. If want more information, or some advice surrounding your structure, then give Paris Financial a call on 1300 4 PARIS.

See you next time at the Tax Champion.

Pat Mannix, Partner, Paris Financial